These are the top five things Brits forget to add to their insurance

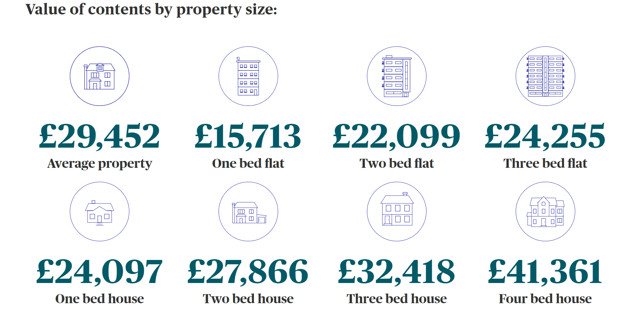

The average UK home contains nearly £30,000 worth of possessions – but only a third of adults have a complete understanding of what their home insurance does and doesn’t cover.

Research of 2,000 people found Baby Boomers estimate they have the most possessions to the tune of £36,166, while Gen Z have the lowest with £21,744.

Advertisement

Hide AdAdvertisement

Hide AdAnd a one-bed flat is estimated to contain £15,713 while a four-bed house has £41,361 worth of goods.

But the average adult adds to their belongings, purchasing around £1,000 worth of impulse buys every year.

It comes as insurance experts at AXA revealed many 'severely undervalue' the items they acquire over time.

And one in 10 of the adults polled admitted when it comes to insurance, they tend to just buy the cheapest policy and hope to never need it.

A dive into the nation's spending habits

Advertisement

Hide AdAdvertisement

Hide AdThe research was carried out by AXA as part of the 'Priority Report' which is a deep dive into the nation's spending habits.

CEO Tara Foley said: "Although the average UK home is estimated to house almost £30,000 worth of contents, we know that many people severely undervalue their belongings and run the risk of being left unprotected.

“While getting a good price for your insurance is important, it’s amazing how many possessions we can acquire over time so make sure your policy covers everything you need it to.”

Despite the older generation having more possessions they are less likely to know exactly what their contents insurance covers than savvy Gen-Zers.

Advertisement

Hide AdAdvertisement

Hide AdThe results also found men are slightly more likely than women to have items in their home which they consider to be irreplaceable or priceless.

The most common of these items was deemed to be photos, followed by jewellery and other pieces of art.

But three in 10 adults, polled via OnePoll, have damaged or lost something, only to then discover it wasn’t actually covered by their contents insurance.

Annual insurance spends

On average, Brits believe they pay out £578 annually on different kinds of insurance, including for their home, car and pets.

Advertisement

Hide AdAdvertisement

Hide AdThose aged 25-34 spend the least of all age groups, at just over £501 – with people aged 55-64 paying the most annually, around £615 per person.

According to AXA, people should specify expensive, high-risk items like engagement or wedding rings, laptops and watches on their insurance policy because they’re easily stolen and resold.

People also often don’t know how much inherited items like antiques, artwork or jewellery are worth, so it’s important they get these valued and tell their insurer too.

Tara Foley added: “It’s easy to miss things when it comes to insurance, after all you often only know you need it when it’s too late.

Advertisement

Hide AdAdvertisement

Hide Ad“It’s worth, every so often, taking an inventory of the things in your home and checking your home and contents insurance is up to date.

“And if you’re not sure whether your policy covers things like lost engagement rings or smashed phone screens – check your policy or get in touch with your insurer.

“That peace of mind is well worth a small amount of ‘life admin’ every 12 months or so.”

Top five things Brits forget to add to insurance

1. Laptops and devices

2. Wedding/Engagement rings

3. Watches

4. Designer handbags

5. Inherited items like antiques, artwork and jewellery