Everything you need to know about the Budget 2021 - Rishi Sunak's key points explained

Chancellor Rishi Sunak unveiled the UK Government’s spending plan in the 2021 Budget today (Wed 3 Mar).

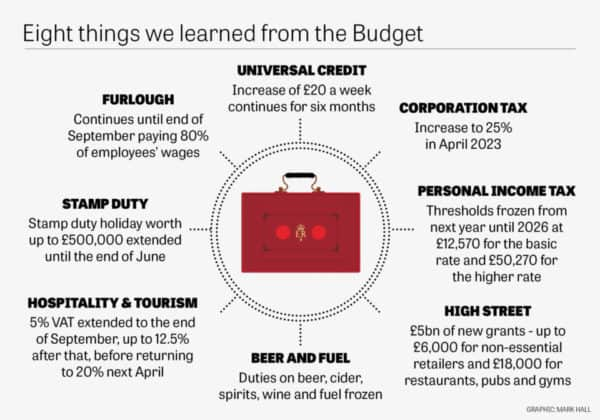

In the annual statement, Mr Sunak revealed plans surrounding the furlough scheme, the fourth self-employed grant, the stamp duty holiday and the Universal Credit uplift.

Advertisement

Hide AdAdvertisement

Hide AdThe chancellor will hold a press conference following his announcement in a Budget first, which will take place at 5pm on Wednesday evening.

Last year’s Budget became known as the “coronavirus Budget” due to the measures the chancellor put in place to support people through the pandemic - and 2021’s statement was no different.

Here’s the key things Rishi Sunak announced today.

What did Rishi Sunak announce?

The chancellor’s Budget focused on giving financial support to those affected by the pandemic.

Mr Sunak said he would do “whatever it takes” during the crisis.

Advertisement

Hide AdAdvertisement

Hide AdIn his opening remarks, the chancellor said there had been “acute damage to the economy”, with more than 700,000 people losing their jobs and the economy shrinking by 10 per cent, which is the largest fall in centuries.

He also said government borrowing was at the highest it has been outside of wartime.

The UK economy is forecast to return to pre-Covid levels by the middle of 2022.

Unemployment is set to peak at 6.5 per cent next year, which is lower than the 11.9 per cent previously predicted.

Advertisement

Hide AdAdvertisement

Hide Ad“It’s going to take this country, and the whole world, a long time to recover from this extraordinary situation,” Mr Sunak added.

Fourth and fifth SEISS grants

The chancellor confirmed that the self-employment income support scheme had been extended.

The fourth grant will cover February to April, and it will be worth 80% of average trading profits up to £7,500.

He also gave details of a fifth grant, which will cover the period of May until July. People will be able to apply for it in summer.

Advertisement

Hide AdAdvertisement

Hide AdMr Sunak said 600,000 more people would be eligible to apply for both grants.

He said: “When the scheme was launched, the newly self-employed couldn’t qualify because they hadn’t all filed a 2019/20 tax return.

“But as the tax return deadline has now passed, I can announce today that, provided they filed a tax return by midnight last night, over 600,000 more people, many of whom only became self-employed last year, can now claim the fourth and fifth grants.”

Furlough scheme

The Job Retention Scheme was due to end in April 2021, but the chancellor announced an extension until the end of September.

Advertisement

Hide AdAdvertisement

Hide AdEmployees will continue to receive 80 per cent of their wages under the scheme, but firms will be asked to contribute 10 per cent in July and 20 per cent in August and September as the scheme is phased out.

So far, the Job Retention Scheme has protected 11 million jobs across the UK with more than one million businesses accessing loans to help them through the crisis.

Business support

There will be a £5billion restart grant for non-essential businesses to help companies restart after lockdown, the chancellor announced.

Firms will be able to receive up to £6,000 per premises.

There will also be £400million made available to help arts venues, like museums and galleries, in England to reopen.

Advertisement

Hide AdAdvertisement

Hide AdThe business rates holiday for firms in England will also continue from April until June.

And, the VAT cut for hospitality businesses will be maintained at 5 per cent until September, with an interim 12.5 per cent rate to apply for six months after that.

Stamp duty holiday

The stamp duty holiday was coming to an end on 31 March but it will now be extended.

As was previously reported, the tax break on properties up to £500,000 will continue until the end of June.

Advertisement

Hide AdAdvertisement

Hide AdIt will be kept at double its standard level until the end of September, before returning to usual levels from the beginning of October.

Both buyers and sellers had called for the six-month tax break, introduced to boost the property market during the coronavirus crisis, to be extended beyond March.

Many people had been racing to complete their purchases before the holiday expires.

Taxation

There will be no changes to rates of income tax, national insurance or VAT, Mr Sunak saod.

Advertisement

Hide AdAdvertisement

Hide AdPersonal income tax allowance will be frozen at £12,570 from 2022 to 2026.

And the higher rate income tax threshold will be frozen at £50,270 from 2022 to 2026.

Yet corporation tax on company profits will rise from 19 per cent to 25 per cent in April 2023.

However, the rate will be kept at 19 per cent for about 1.5 million smaller businesses.

Advertisement

Hide AdAdvertisement

Hide AdAlcohol duties will be also frozen for the second year in a row, along with fuel duty.

Universal Credit uplift

The Universal Credit uplift has also been extended for six months.

Claimants who receive Universal Credit have been given a weekly £20 increase during the pandemic, but the government previously said the rise was “temporary”.

But as restrictions are set to continue, the Treasury was under pressure from MPs, charities and members of the public to extend the uplift, worth £1,040 per year, past the end of March.